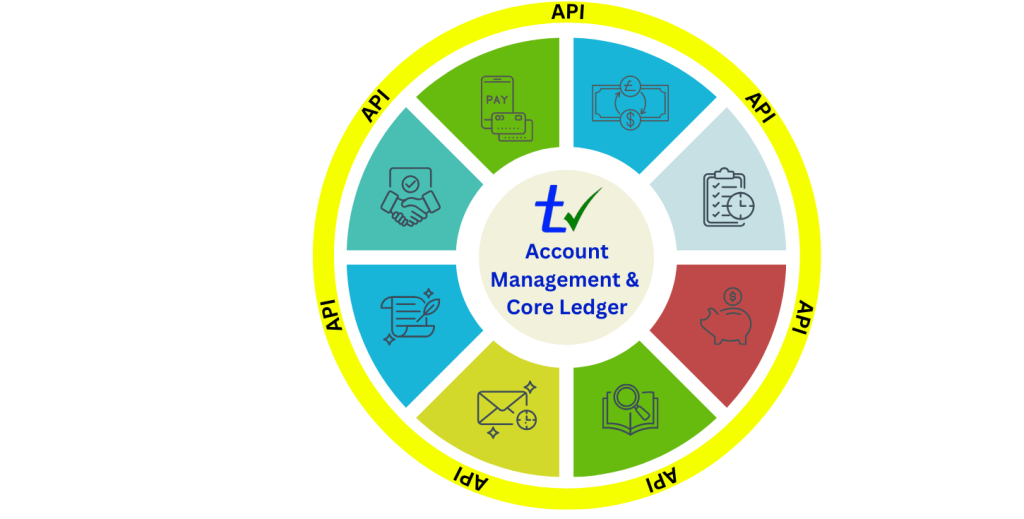

Products Overview

Trusek has developed a comprehensive, ready-to-go BaaS infrastructure encompassing core Ledger, Account Management, Risk, Compliance, and Reporting functionalities.

This robust platform enables a diverse range of interconnected financial services and capabilities.

Payment & Settlement

Processing

Trusek’s Payment & Settlement module offers comprehensive support for real-time and batch processing, enabling seamless payment execution and reconciliation. Key features include:

- Real-time Payment Processing: Facilitates real-time payments through integration with 3rd Parties connected to relevant Payment Networks/ Schemes (e.g. FPS and SEPA).

- Third-Party Integrations: Seamlessly integrates with third-party banking and payment providers via APIs.

- Real-time Account Updates: Provides real-time updates on account balances and transaction statuses.

- Dual entry accounting throughout to aid auditing

- Efficient Bulk Payments: Enables efficient processing of bulk payments and payouts.

- Streamlined Reconciliation: Simplifies settlement and reconciliation processes with real time Bank Reconciliation reports.

- Comprehensive Reporting: Generates customer statements and other insightful reports.

Foreign

Exchange

Trusek empowers your business with robust Foreign Exchange capabilities, offering seamless integration with a wide range of third-party Forex Providers. This ensures access to the global currency markets you require. Key features include:

- Extensive Currency Support: Access to over 65 currencies, providing flexibility for your business needs.

- Single account holding multiple currency balances

- Control Over Conversions: You maintain full control over when and what currency conversions to execute, eliminating forced conversions.

- Comprehensive Trading Support: Supports Spot, Limit, and Future trades to meet your diverse trading requirements.

- Real-time Operations: Enables real-time currency conversions and transaction recording for transparency.

- Streamlined Account Management: Currency accounts are set up in real-time for immediate use.

- Efficient Reconciliation: Streamlines settlement and reconciliation processes for accurate and timely financial reporting.

- Comprehensive Reporting: Generates insightful reports on all aspects of your foreign exchange operations.

Integration to Forex &

Payment Providers

The API Connections Hub expands the core service capability by supporting integration with third party Foreign Exchange, Payments, Risk, Compliance & Financial services providers.

- External integrations may include:

- Currency exchange

- KYC/sanctions checking

- AML transaction monitoring

- Banking and reconciliation

- Savings, Loans and Overdrafts

- National and International payments

- Visa/MasterCard transaction processing (issuing)

Card Issuing

The Trusek Platform enables the integration of a wide variety of card products. This typically requires either direct membership with Card Schemes or establishing partnerships with BIN Sponsors and Issuers.

- API Integration to 3rd Party Card Issuers / Processors/ BIN Sponsors

- Single and Multi-Currency Card Support

- Visa and MasterCard Support

- Business and Individual card programmes

- PrePaid, Credit and Debit Cards Supported

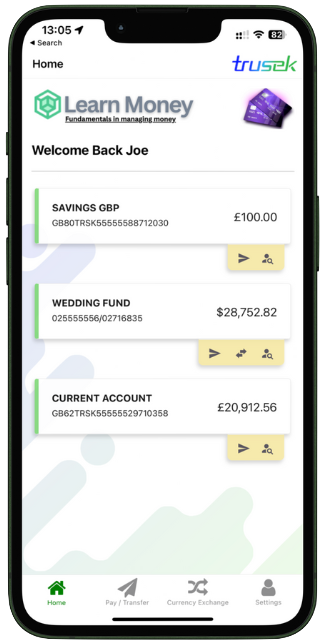

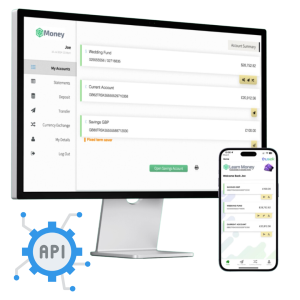

White Label Web UI,

API & Mobile Apps

- The Trusek Solution provides unparalleled flexibility as it can be customised to your specific needs through both White Label web user interfaces and robust API integration options.

- Enhanced User Experience:

Offers an optional white-label mobile app for iOS and Android for enhanced customer convenience.

Cost Effective

Quick Setup

Scalable

White Label_Mobile App

White Label_Web UX

Integration Partners