Solution Overview

Trusek has developed a comprehensive, ready-to-go BaaS infrastructure encompassing core Ledger, Account Management, Risk, Compliance, and Reporting functionalities.

This robust platform enables a diverse range of interconnected financial services and capabilities.

Core Ledger &

Account Management Platform

- Robust Transaction Processing: Securely records all activities and transactions in encrypted, dedicated, fault-tolerant cloud-based databases.

- Comprehensive Reporting: Generates reports for management, regulatory compliance, and client needs.

- Centralized Administration: Offers a comprehensive back-end interface for managing all aspects of the platform.

- Customer-Centric Interfaces: Provides a user-friendly interface for customer registration, account management, and payment initiation.

- Flexible Support Channels: Includes a customer support call centre interface, adaptable for in-house or outsourced operations, as well as a branch/agent interface for face-to-face interactions.

- Growth-Oriented Ecosystem: Supports an affiliate program to incentivize referrals and drive client acquisition.

- Enhanced User Experience: Offers an optional white-label mobile app for iOS and Android for enhanced customer convenience.

“Single View” Dynamic

Multi-Currency account

Trusek uniquely enables Dynamic Multi-Currency accounts, allowing customers to seamlessly make payments in multiple currencies without the needing to pre-fund each currency account individually in advance.

| £ | Currency accounts set up in real time |

| $ | Single account to hold multiple currencies |

| ¥ | Simple user-friendly interface |

| € | Supports Spot, Limit & Future trades |

| ₦ | All trades recorded in real time into customer’s accounts |

| ₹ | Double entry accounting throughout to aid auditing |

| ₩ | Automatic Future payments |

| ฿ | Option to attach to a Visa/MasterCard |

| ₺ | Customer can access their accounts through Web, Call Centre, and Branch facilities (where available). |

Risk, Compliance &AML

Trusek empowers you to navigate the complex regulatory landscape with robust Risk, Compliance, and AML capabilities. Our solutions seamlessly integrate with third-party services, enabling you to conduct thorough due diligence and ensure compliance with all relevant regulations.

- Set & Regulate Onboarding Rules for KYB/KYC/AML compliance policies for all Clients

- API Integration to 3rd Party KYB/ KYC/ AML / Sanction List Service Providers

- Set and regulate ongoing checking rules

- In-built transaction monitoring capability for countries, currencies, beneficiaries, transaction amounts, transaction volumes etc

- API Integration with 3rd Party Transaction Monitoring Providers

- Comprehensive Reporting

Loans, Overdrafts and Savings

Trusek‘s Ledger and Account Management modules provide comprehensive support for Loans, Overdrafts, and Savings, encompassing the following key features.

- Lending & Savings Capabilities: Robust functionalities for managing lending and savings products.

- Account Management: Comprehensive management of savings and loan accounts.

- API Integration to 3rd Party Savings and Loans Banking Partners

- Overdraft Management: Efficiently manage overdraft facilities for customers.

- Settlement & Reconciliation: Streamlined processes for settlements and reconciliations.

- Comprehensive Reporting: Generate insightful reports across all aspects of lending and savings operations.

- Interest Calculation: Accurately calculate interest daily, monthly, and annually.

- Product Information: Maintain detailed information about savings account products.

- Customer Application: Facilitate customer account application processes.

- Broker interface for applying and managing accounts, can be White Labelled

Additional Account Features

In addition to the multi-currency accounts the Trusek platform supports:

- Bulk upload and regular payments

- Loans, credit/debit cards, overdrafts and savings accounts

- Separate interfaces to support Call Centre, Agent and Admin functions

- e-invoice creation and management

- Affiliate programmes

API Connections Hub

The API Connections Hub expands the core service capability by supporting integration with third party Foreign Exchange, Payments, Risk, Compliance & Financial services providers.

- External integrations may include:

- KYC/sanctions checking

- AML transaction monitoring

- Banking and reconciliation

- National and International payments

- Currency exchange

- Visa/MasterCard transaction processing (issuing)

- Savings, Loans and Overdrafts

Cost Effective

Quick Setup

Scalable

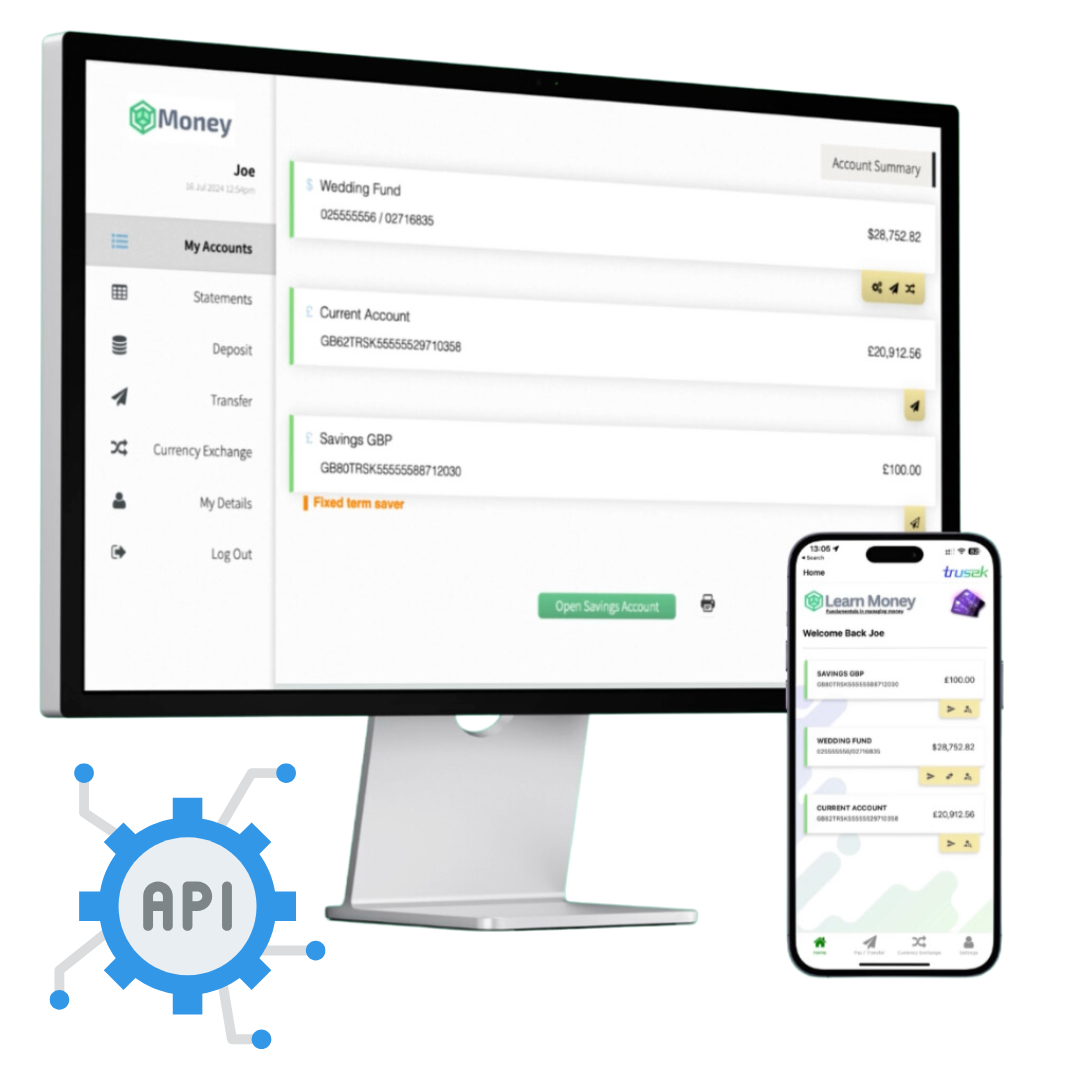

White Label_Mobile App

White Label_Web UX

Learn Money

This app has been specificly designed to aid all age groups in the day to day task of managing money, this is a learning tool that has all the features you would expect to find with modern banking applications; including, sending & recieving payments, managing recipients and currency exchange.

Integration Partners