🚀 Key Elements needed to add Fx & Multi-Currency Capabilities to your Platform

Here’s What You Need to Know 💱💳

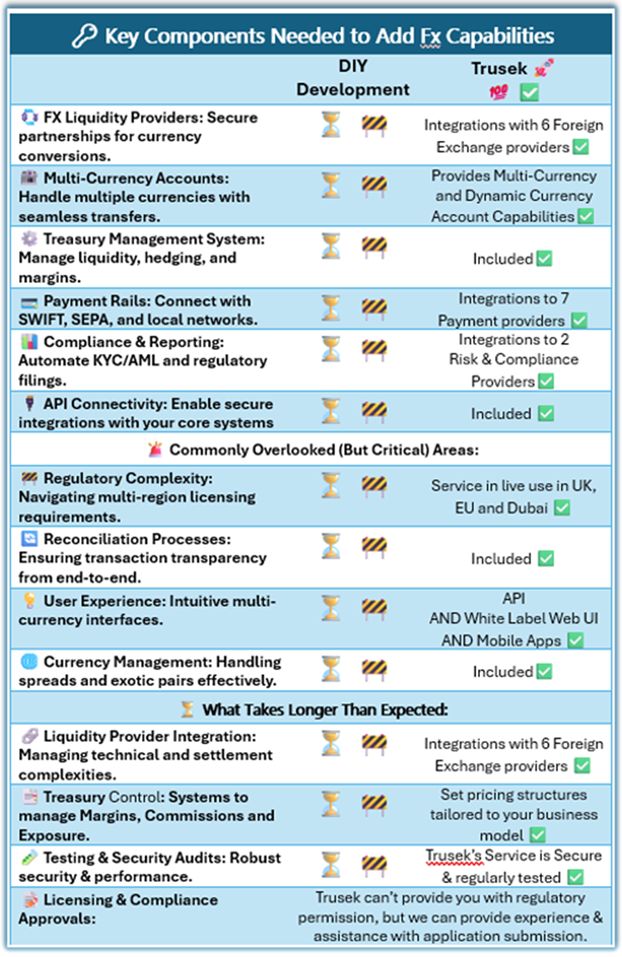

Expanding into multi-currency FX is a huge opportunity—but it comes with challenges.

There’s more to it than just developing and interface to an Fx provider. Here’s a quick guide to what’s involved, what’s often overlooked, and what typically takes longer than expected. 👇

🔑 Key Components You’ll Need:

💱 FX Liquidity Providers: Secure partnerships for currency conversions.

🏦 Multi-Currency Accounts: Handle multiple currencies with seamless transfers.

⚙️ Treasury Management System: Manage liquidity, hedging, and margins.

💳 Payment Rails: Connect with SWIFT, SEPA, and local networks.

📊 Compliance & Reporting: Automate KYC/AML and regulatory filings.

🔌 API Connectivity: Enable secure integrations with your core systems.

🚨 Commonly Overlooked (But Critical) Areas:

🚧 Regulatory Complexity: Navigating multi-region licensing requirements.

🔄 Reconciliation Processes: Ensuring transaction transparency from end to end.

💡 User Experience: Building intuitive multi-currency interfaces.

🌐 Currency Pairs Management: Handling spreads and exotic pairs effectively.

⏳ What Takes Longer Than Expected:

🔗 Liquidity Provider Integration: Managing technical and settlement complexities.

📑 Treasury Automation: Systems to manage Margins, Commissions and Exposure.

🧪 Testing & Security Audits: Ensuring robust security and performance.

📝 Licensing & Compliance Approvals: An essential documentation-heavy process.

✅ The Bottom Line: A successful multi-currency FX offering demands careful planning and expertise.

Get ahead by addressing these challenges early! Let’s discuss! 💬👇

✅ Call us or click the link (Get In Touch). Our ready-for-service could be up and ready in less than 6 weeks! 🚀

hashtag#Fintech hashtag#Payments hashtag#ForeignExchange hashtag#MultiCurrency hashtag#TreasuryManageme